Is the 2009 recession over?

At the heels of one of the worst financial and housing meltdowns in the history of this country, rising unemployment and shrinking GDP the sentiment has surprisingly jumped from doom and gloom to mindless optimism.

At the heels of one of the worst financial and housing meltdowns in the history of this country, rising unemployment and shrinking GDP the sentiment has surprisingly jumped from doom and gloom to mindless optimism.One does not need to look far to overhear bullish sentiment about the US stock market and little bits of chatter asking hopefully whether this recession is slowing down. Not to be outdone, this irrational exuberance (Greenspan would be proud) goes beyond the local talking heads or financial gurus at the water cooler, our own government hot shots have now proudly announced a reversal in fortune. Both Tim Geithner (tax cheat) and Ben Bernanke ("student" of the Great Depression) have commented on our strong economy and the ability for us to recover.

So what is behind this jolly rhetoric and can we deduce any veritas seemingly from the same people who lead us into this debacle in the first place?

Regarding pundits, talking heads, 99% of the staff of CNBC and other financial channels and other TV personalities - they know nothing. This may sound somewhat condescending and I certainly do not have a degree in economics or financial witchcraft, but as someone who has participated in the market for years I can comfortably state that the people on TV are there for entertainment. There are a handful of individuals on this planet, yes planet, that can successfully time and understand the complex economies of modern countries. Even people like Warren Buffet, arguably the best long term investor of his time got his accounts decimated when he pulled the trigger early on the US equities. If Buffet got it wrong, then Joe S. Pundit knows even less. Their job is to report news after the fact and their attempts at drawing conclusions are laughable at best. One needs to spend a short time watching these people to realize that the conclusions being drawn are infantile and baseless.

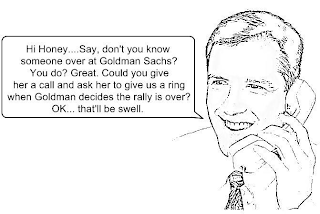

Similarly the political elite armed with their ivy league diplomas fair similarly badly in their prognosticating ability and can only infer a small sample of information from key economic data points. However the political elite has a slightly different agenda, then the aforementioned TV rating seeking pundit, the likes of Bernanke is interested in fostering a positive image.

So far we have had housing data, unemployment data, manufacturing numbers and GDP continually demonstrate the systematic breakdown of our economy. However because the rate of change has slowed down, the people responsible for reporting the reality can't help but place a positive spin on the rate of change and falsely deduce that this suggests the end of our recession. Perhaps it does, but this conclusion is so awfully premature that one must wonder if intellectual dishonesty is at play here. For those with intellectual honesty, the meteoric rise in the stock market over the past two months has clouded any remnants of rational reasoning. *cough* bank stress tests *cough*

So what do our politicians gain by fostering an overly positive imagine of our economy? Simply put, we are broke. We do not have the money to pay for all the goodies that the new administration has promised and we are forced to raise money by selling treasuries. The principal buyer and holder of our debt is China, a peculiar irony to be bailed out by a communist nation, and they must continue to purchase our debt. Why would they? As of now we are still the world power and our economy has the potential to generate output that rivals all of Europe. However as we spiral out of control into a recession/depression/whatever, the Chinese rightfully wonder if purchasing additional debt is prudent! So leave it to our politicians to give the good Communists a propaganda campaign that even they can be jealous of.

After all, what better way to continue spending our way out of our demise then to shift the burden onto someone else? Eventually the gravy train will come to a screeching halt and reality will sink.

Bernanke has vowed to maintain the 10 year yield at 3%, in layman terms this means he is going to ensure that someone continually buys the 10 year treasury note. What does 3% give the United States? First it continues to provide cheap mortgages to people and hopefully incentivize new home purchases and secondly, keeps the Chinese happy and prevents them from unwinding their position. Unfortunately in order to buy our own notes, we need to print some cash and debase our currency. Debasing our currency if done in small doses has the benefit of lowering the dollar and thus shrinking our debt, may not make the Chinese happy, but does not give them many options. Sadly debasing the currency also ushers in inflation and inflation is battled by raising rates, something that Bernanke could do at any time. However raising rates when the economy has not actually improved ushers in an economic concept called stagflation. Stagflation is bad, ask Jimmy Carter.

Is the recession over? Why would it be! Can it get worse? Yes, much worse.

Protect yourself and do not buy into the hype.

Comments

Post a Comment