Bernanke's Bazooka, what does QE3 mean to you?

The Federal Reserve undertook a very serious decision last week announcing QE3 and while the stock market and commodity market responded positively, it remains unclear what this decision means for the average American.

The seriousness of the Fed decision cannot be understated and is hinged on the following commitment:

The question remains, how does this failure actually impact you?

While some clueless economists like Krugman celebrate this intervention and clamor for more, others are far more skeptical. Why the skepticism?

What the Federal Reserve is trying to do, is first and foremost induce lending. He wants Americans to borrow more. More borrowing is what fuels our credit-driven economy and for the past 30+ years this has been a cycle that most are familiar with, it is also the "business cycle" or "bubble economy" that most have become familiar with. As credit spurs bubbles form and when loans default bubbles burst. Because our interest rates are fixed and are therefore artificial and manipulated the severity of the bubbles become greatly exaggerated. Think of this as price-fixing a specific good at a price that is way below actual market value. First the good is consumed at a rapid rate and then shortages occur, but in the case of money, our central planners simply create more out of thing air. This creation unfortunately makes everyone poorer.

Allow me to present three important charts to you:

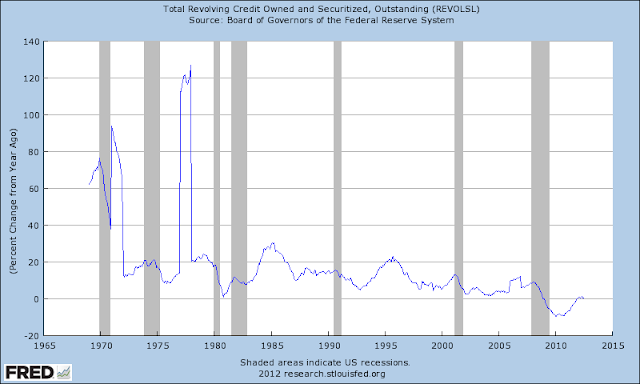

Total Revolving Credit: Starting from the 1980s you can see that revolving credit (credit cards, etc) coincide with the "boom" and contraction with the "bust". The contraction in credit happens well below the recession (marked in gray). This is what the Fed wants to stimulate and despite the trillions of dollars injected into the system the borrowing is well below previous cycles. This is because in this economy where the debt is saturated the amount of loans that can be originated is limited.

Total Non-Revolving Credit: Non-Revolving credit (fixed loans like auto, school, home) is doing much better and is responding to the low interest rates. Whether this is wise is to be determined and unless income and employment improves, this remains to be unwise.

Total Credit: Despite non-revolving, total credit in the private economy continues to decline and this is what worries the Federal Reserve. As the chart plainly shows this credit contraction is unprecedented and in an economy that requires credit, like a drug addict needing another snort, this chart spells recession. The only entity that has acquired debt is the Government (red line), which is just a round-about way for saddling Americans with more debt. Almost as if, our refusal to take on more debt is simply disregarded by our Government, a disregard that paves a path of ruin. Debt does not create prosperity, particularly when it is clear that after 30 years we need to clear the debt out of the system, not take on more of it.

What does all this debt and stimulation achieve?

There is a clear group of winners and losers in this QE crazy world we live in.

The winning group is the banking and mortgage industry. According to the Fed's own data, the outstanding MBS market stands at:

Total: 7.5 Trillion

Fannie: 2.5 Trillion

Freddie: 1.8 T

Ginnie: 600B

Private: 2.5 Trillion

As of this writing the Fed has already purchased 1.25 Trillion of this paper (from QE1) and is now planning to buy 40 Billion per month until the economy improves. Although not all MBSs are made equal, with some performing much better than others, presumably the Fed buys the worst performing assets first. His purchases are designed to stabilize the holders of this debt and prevent them from going under. The Fed owns almost 20% of the market, assets that he bought with printed money. In addition, banks were bailed out through TARP with Fannie/Freddie currently owe the taxpayers over 150 Billion dollars. This is a wealth transfer, pure and simple.

The wealth transfer occurs though creation of additional money in the system. If you were to regard credit and money as one and the same, then all these bad loans that are being rescued were once credit that entered the system. The system flushed with credit will respond by rising prices. Upon discovering that much of this credit was poor and could not be repaid through production of good and services the debt should have been liquidated, thus causing a contraction and lowering of prices. That has not happened. The originators of the loans are sitting pretty at the expense of us all.

The rising prices are showing up even in the flawed and highly skewed Government CPI data:

Biggest spike since August 11th, and yet we are lead to believe that prices only increase when the economy is doing well - which certainly begs the question as to why we need more stimulus.

By looking through the latest BLS data, you can see how this expense shows up (income ranges and percent of income spent on basics):

Rising prices across all sectors smashes the working poor to smithereens. If wealth is the formation of capital then capital cannot be formed when the poorest Americans are spending over 70% of their income of necessities. To add insult to injury, the poorest Americans are on welfare (food, housing, medicine), welfare that is a direct result of rising prices for wages never keep up in such an inflationary environment.

These policies directly hurt those that are the most in need, be mindful of those that in any way praise or encourage these kinds of policies.

The seriousness of the Fed decision cannot be understated and is hinged on the following commitment:

"The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability"The actual plan consists of three primary actions. Outright purchase of MBSs, buying long term Government bonds and keeping the short term rates near zero until 2015. What is frightening is that this plan will continue until the economy improves, a plan that has been in plan since 2009 and has done very little for the economy, a fact we can be sure otherwise QE3 would not have been announced. It should worry you that our central bank and Government agencies continue employing strategies that have failed for years.

The question remains, how does this failure actually impact you?

While some clueless economists like Krugman celebrate this intervention and clamor for more, others are far more skeptical. Why the skepticism?

What the Federal Reserve is trying to do, is first and foremost induce lending. He wants Americans to borrow more. More borrowing is what fuels our credit-driven economy and for the past 30+ years this has been a cycle that most are familiar with, it is also the "business cycle" or "bubble economy" that most have become familiar with. As credit spurs bubbles form and when loans default bubbles burst. Because our interest rates are fixed and are therefore artificial and manipulated the severity of the bubbles become greatly exaggerated. Think of this as price-fixing a specific good at a price that is way below actual market value. First the good is consumed at a rapid rate and then shortages occur, but in the case of money, our central planners simply create more out of thing air. This creation unfortunately makes everyone poorer.

Allow me to present three important charts to you:

Total Revolving Credit: Starting from the 1980s you can see that revolving credit (credit cards, etc) coincide with the "boom" and contraction with the "bust". The contraction in credit happens well below the recession (marked in gray). This is what the Fed wants to stimulate and despite the trillions of dollars injected into the system the borrowing is well below previous cycles. This is because in this economy where the debt is saturated the amount of loans that can be originated is limited.

Total Non-Revolving Credit: Non-Revolving credit (fixed loans like auto, school, home) is doing much better and is responding to the low interest rates. Whether this is wise is to be determined and unless income and employment improves, this remains to be unwise.

Total Credit: Despite non-revolving, total credit in the private economy continues to decline and this is what worries the Federal Reserve. As the chart plainly shows this credit contraction is unprecedented and in an economy that requires credit, like a drug addict needing another snort, this chart spells recession. The only entity that has acquired debt is the Government (red line), which is just a round-about way for saddling Americans with more debt. Almost as if, our refusal to take on more debt is simply disregarded by our Government, a disregard that paves a path of ruin. Debt does not create prosperity, particularly when it is clear that after 30 years we need to clear the debt out of the system, not take on more of it.

What does all this debt and stimulation achieve?

There is a clear group of winners and losers in this QE crazy world we live in.

The winning group is the banking and mortgage industry. According to the Fed's own data, the outstanding MBS market stands at:

Total: 7.5 Trillion

Fannie: 2.5 Trillion

Freddie: 1.8 T

Ginnie: 600B

Private: 2.5 Trillion

As of this writing the Fed has already purchased 1.25 Trillion of this paper (from QE1) and is now planning to buy 40 Billion per month until the economy improves. Although not all MBSs are made equal, with some performing much better than others, presumably the Fed buys the worst performing assets first. His purchases are designed to stabilize the holders of this debt and prevent them from going under. The Fed owns almost 20% of the market, assets that he bought with printed money. In addition, banks were bailed out through TARP with Fannie/Freddie currently owe the taxpayers over 150 Billion dollars. This is a wealth transfer, pure and simple.

The wealth transfer occurs though creation of additional money in the system. If you were to regard credit and money as one and the same, then all these bad loans that are being rescued were once credit that entered the system. The system flushed with credit will respond by rising prices. Upon discovering that much of this credit was poor and could not be repaid through production of good and services the debt should have been liquidated, thus causing a contraction and lowering of prices. That has not happened. The originators of the loans are sitting pretty at the expense of us all.

The rising prices are showing up even in the flawed and highly skewed Government CPI data:

Biggest spike since August 11th, and yet we are lead to believe that prices only increase when the economy is doing well - which certainly begs the question as to why we need more stimulus.

By looking through the latest BLS data, you can see how this expense shows up (income ranges and percent of income spent on basics):

Rising prices across all sectors smashes the working poor to smithereens. If wealth is the formation of capital then capital cannot be formed when the poorest Americans are spending over 70% of their income of necessities. To add insult to injury, the poorest Americans are on welfare (food, housing, medicine), welfare that is a direct result of rising prices for wages never keep up in such an inflationary environment.

These policies directly hurt those that are the most in need, be mindful of those that in any way praise or encourage these kinds of policies.

Comments

Post a Comment