Reagan revolution and Economic ignorance.

Reagan changed the country in multiple ways and is regarded to this day by conservatives and Republicans as the best president America ever had. Reagan's legacy is easy to admire given his eloquent and charming ability to present and convince the public that smaller government is better. However his policies have created some confusion among politicos and has left many people preaching and pushing for Reagan style policies while failing to understand the underlying economic principles. I will try to present to you that Reagan's policies were eclipsed by a much larger and powerful force and unfortunately according to the data, Reagan's legacy consists mostly of rhetoric and little substance. While the Reagan revolution inspired many to appreciate the free market and love small government it also inspired a legion of economically ignorant individuals.

Let us begin with the positive impact Reagan had on human activity. Through several tax reforms beginning in 1981 the overall tax rates dramatically decreased across all brackets. In 1981, top tax rate dropped from 70% to 50% and in 1986 dropped from 50% to 28%. Most people regard these powerful moves as the panacea that finally restored employment and many fondly remember the economic boom during most of Reagan's tenure. This kind of impact positively benefits human action as it inspires personal consumption and allocation of private funds into the economy which is always better than allocation of public funds. It is extremely difficult to determine just how much positive impact an economy experiences when people spend money the way they see fit as opposed to a government agency. However what is easy to determine is that Reagan's tax cuts were NOT the driving force behind the economic boom of the 1980s, let me show you why.

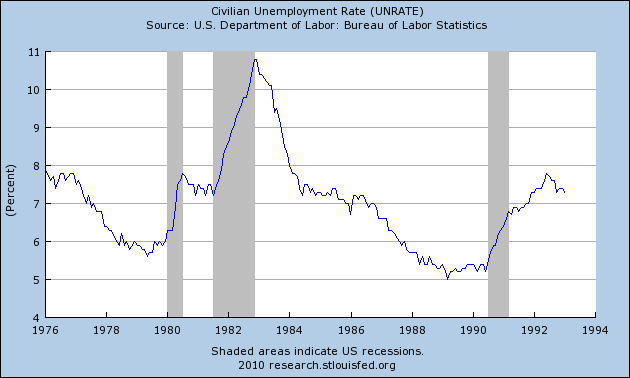

First of all, let us use a broad measure of economic health. Employment. Most people would agree employment drives the economy, generates private capital, allows for investment and yes, even generates more income for our beloved government.

As you can see Reagan's first year were rough and unemployment was high, peaking in late 1982. However unemployment quickly dropped and continued to drop after Reagan's departure only increasing during the early 90s, the recession that cost Bush Sr. a second term. Please ask yourself at this point, what caused the early 80s recession? Or the early 90s recession? (Keep reading for the answer)

Now this is where you must pay attention. Forget all the feel-good punditry that may have been drilled into you head, tax cuts cannot by themselves solve every economical problem. Especially when at the very same time, federal government spending is increasing at a rapid rate. Now most have accepted that under Reagan our debt and deficit went up, but this debt/deficit increase has been justified as the cost of destroying Communism. While my family is extremely thankful for Reagan's committed fight against the USSR, the following table suggests that spending was not limited to defense, not even close.

As you can see, government spending went up everywhere! Even as Reagan joked about the war on poverty being a lost cause and pledged to privatize social security and dismantle the department of Education; welfare, pension and education spending skyrocketed. In fact the idea that defense spending drove this country into some deficit hole is not entirely true, defense spending as a percentage of total spending barely increased. The problem of course with all this spending is that it either requires tax income or the issuance of debt, which simply means that future taxes will be levied on unsuspecting Americans.

So did tax cuts really create this boom and lead to government spending? If tax cuts were so effective, then why was there a recession in the early 1990s? For that matter, why was there a recession of the 1980s? Let's address the latter. Many bitterly recall the Jimmy Carter years, the stagflation and the general economic malaise where the misery index went through the roof. Yet the later 1970s has employment rates that were significantly better than Reagan's early years, so what happened there? Did Carter cut taxes? No. There is a much more powerful force in America, a force that most people do not understand or sorely underestimate. This force is our central bank or better known as the Federal Reserve. Observe the following:

This chart represents non-revolving credit or straight up loans held by the consumer. Loans are driven by banks and certain conditions that promote lending. Before we discuss conditions for lending, compare and contract this chart with the employment chart. Notice that the two charts are almost mirror images of each other and notice that recessions coincide with drops in loans. That is, the more loans held by the public the better the economy and vice versa. Notice also as the loans increase, unemployment drops. Observe that the late 1970s high employment coincided nicely with a credit expansion. Similarly, mid 1980s had an even greater expansion and unemployment dropped even faster.

So what kind of environment is especially conducive to loan generation? First and foremost, short term interest rates. Our interest rates are centrally planned and controlled by the Fed Chairman and the governors of the respective federal reserve banks. Below is the short term rate during the 1980s.

As you can see, the late 1970s and early 1980s experienced some of the highest rates in history. This also coincides with high unemployment and depressed lending activity. It should be no surprise that lending increases as rates drop as it becomes cheaper for banks to lend, but of course there is always a price to pay. The problem with any centrally planned economy is that humans make serious mistakes and when artificially managed rates produce too much lending, booms occur and are always followed by busts. Politicians, public educators and most economists will call this the business cycle. Of course when they screw up it's always the fault of the free market, as if the free market can possibly exist in a land where the rates are centrally planned, banks are insured from failure and money has no actual value. But interest rates are not the only way to flood an economy with money.

There is another way to increase lending and one of the primary methods of inflation in this country; creation of credit. This is done via the commercial banks and are always backstopped by the lender of last resort - the Federal Reserve. Below is the chart that depicts total money supply, known as M2.

What you see above is critically important. This essentially shows the expansion and contraction of the amount of money, the one thing we really hate to see expand. Because as the amount of money increases prices invariably go up! What you see above is an example of inflation and deflation. Note: This is a chart representing yearly change, the higher the peaks the higher the rate of change. Our total money supply continues to grow, as can be seen by significant price jumps in both the 70s and 80s.

You can see that combined with total money supply and low interest rates, the amount of credit available is at it's highest. This high amount of credit then promotes an economic boom, high employment and general happiness. Sadly this boom is not generated due to real and meaningful reasons and will invariably result in a bust. This is a nutshell explains the boom of the 1980s and the subsequent bust, caused a recession, forced Bush Sr. to raise taxes and brought in Bill Clinton. Hopefully you are realizing that presidents and their policies are not the driving force, instead as they say, it's the economy stupid.

As a final indication that America's economy revolves around the expansion of credit, observe the total loans issued by commercial banks.

Although we could infer from previous charts that some kind of expansion fueled the non-revolving credit, the above chart demonstrates clearly what drives our economy. You can see clearly what caused the recession of the early 80s and 90s and the massive expansion of loans during the Reagan boom time.

At this point you may be thinking, expansion of credit is pretty good! Just from the charts above it would appear that contraction of credit is bad, expansion is great and why don't we just expand all the time? Well, despite the fact that it has been tried and failed we do not live in a land of unicorns. Expansion of credit and low interest rates create inflation, that is the expansion of money which invariably leads to higher prices. Worse yet the money expansion cannot be directed, it acts like water and flows wherever it pleases. At times this capital flows to employers who invest and expand, hire more people and create growth. But there is a capacity to this and if the money flow is not stemmed it flows into assets. Assets that often tend to be speculative in nature, like stocks or real estate! Notice that the rapid expansion of credit in the 1980s also caused a violent and nasty stock market correction of 1987. Like a volcano the excesses get built up and in time will explode in a violent fashion. Worse yet, the entire economy begins to function like Bernie Madoff's private account, requiring more and more debt to sustain itself. Each bubble blown has to be larger than the previous bubble in order to avoid the much needed and welcomed contraction.

What inspired me to write this, is the constant and incessant push by Republicans and conservatives for a revival of the Reagan economic policy. A local talk show host by the name of Jay Severin today mentioned that Scott Brown's ascension into the US Senate will finally offer salvation in the form of across the board tax cuts. How sad it is when such a respected "libertarian" voice lacks what appears to be basic economic knowledge. You see, Reagan's tax cuts were primarily driven to accomplish one thing and one thing only. Promote consumption. While Reagonomics can be best described as Monetarist stemming from the Chicago school of thought, they are still Keynesian in nature. That is to say, both schools rely on consumer spending to lift the economy out of whatever centrally planned hole it finds itself in. Difference being that Keynesians foolishly rely on government spending, while Monetarists rely on consumer spending via employment investments and tax cuts. Former being Statist, evil and broken and the latter being partially correct provided economic expansion is driven by real investments and not more debt. A credit expansion like the one starting in the early 1980s worked very well given the high concentration of savings that occurred during the 1970s (high interest rates promoted that), so while the dramatic expansion did invariably lead to a boom/bust cycle the foundation was "solid". It is absolutely paramount to understand however that all subsequent booms were launched with cheap credit and loose monetary policy from the Federal Reserve. This is the catch and the hallmark of the past several decades. Our ruling class refused to accept and experience a natural contraction and instead preferred the good times of the boom that were no longer based on solid savings (like late 1970s), but cheap and easy to obtain credit.

The problem is further exacerbated by a government that sees economic expansion and ramps up the spending putting more and more pressure on future generations to clean up the mess. Unfortunately spending that is a function of debt can only go so far and will eventually have to be corrected via debt defaults, contraction and recessions. Sadly when the taxpayer gets demolished during a recession, our government fails to understand that it's previous spending was merely a function of a credit boom and instead of reigning in spending levies more taxes and expands social welfare!

What you see above is not sustainable, not real and HAS to be corrected and you can also get a glimpse of why this time it is quite different. An economy built on a house of credit cards will not stand. Furthermore a political base that failed to understand and comprehend the Reagan era, fails to understand the chart above will never lead us out of our impending economic hardships.

Ironically the economic ignorance behind pushing for a Reagan style across the board tax cut will have the opposite effect! All extra money will be used to pay down outstanding consumer leverage, further contract credit and put the federal government further into debt!

We need to be the party of REAL fiscal sanity and push for fundamental changes that will fix our ailing financial sector. Instead of implementing economic policies that only made sense 30 years ago, we should instead push for more transparency of the federal reserve system, break down the insanity of the FDIC, talk about sound money and how to restore value to our currency. This is the path to economic salvation, we can no longer operate under economic ignorance and hope that another cheap credit boom can buy us a few more years of happiness.

Let us begin with the positive impact Reagan had on human activity. Through several tax reforms beginning in 1981 the overall tax rates dramatically decreased across all brackets. In 1981, top tax rate dropped from 70% to 50% and in 1986 dropped from 50% to 28%. Most people regard these powerful moves as the panacea that finally restored employment and many fondly remember the economic boom during most of Reagan's tenure. This kind of impact positively benefits human action as it inspires personal consumption and allocation of private funds into the economy which is always better than allocation of public funds. It is extremely difficult to determine just how much positive impact an economy experiences when people spend money the way they see fit as opposed to a government agency. However what is easy to determine is that Reagan's tax cuts were NOT the driving force behind the economic boom of the 1980s, let me show you why.

First of all, let us use a broad measure of economic health. Employment. Most people would agree employment drives the economy, generates private capital, allows for investment and yes, even generates more income for our beloved government.

As you can see Reagan's first year were rough and unemployment was high, peaking in late 1982. However unemployment quickly dropped and continued to drop after Reagan's departure only increasing during the early 90s, the recession that cost Bush Sr. a second term. Please ask yourself at this point, what caused the early 80s recession? Or the early 90s recession? (Keep reading for the answer)

Now this is where you must pay attention. Forget all the feel-good punditry that may have been drilled into you head, tax cuts cannot by themselves solve every economical problem. Especially when at the very same time, federal government spending is increasing at a rapid rate. Now most have accepted that under Reagan our debt and deficit went up, but this debt/deficit increase has been justified as the cost of destroying Communism. While my family is extremely thankful for Reagan's committed fight against the USSR, the following table suggests that spending was not limited to defense, not even close.

1980

|

1981

|

1982

|

1983

|

1984

|

1985

|

1986

|

1987

|

1988

|

1989

| |

Total Spending

|

591

|

678

|

746

|

808

|

852

|

946

|

990

|

1,004

|

1,064

|

1,144

|

Pensions

|

134

|

158

|

176

|

189

|

196

|

206

|

217

|

226

|

238

|

253

|

Health Care

|

55

|

66

|

74

|

81

|

88

|

99

|

106

|

115

|

123

|

133

|

Education

|

33

|

35

|

28

|

28

|

29

|

31

|

32

|

31

|

33

|

38

|

Defense

|

168

|

194

|

222

|

247

|

269

|

295

|

314

|

320

|

330

|

343

|

Welfare

|

55

|

64

|

68

|

81

|

70

|

85

|

74

|

75

|

78

|

83

|

(In Billions)

| ||||||||||

As you can see, government spending went up everywhere! Even as Reagan joked about the war on poverty being a lost cause and pledged to privatize social security and dismantle the department of Education; welfare, pension and education spending skyrocketed. In fact the idea that defense spending drove this country into some deficit hole is not entirely true, defense spending as a percentage of total spending barely increased. The problem of course with all this spending is that it either requires tax income or the issuance of debt, which simply means that future taxes will be levied on unsuspecting Americans.

So did tax cuts really create this boom and lead to government spending? If tax cuts were so effective, then why was there a recession in the early 1990s? For that matter, why was there a recession of the 1980s? Let's address the latter. Many bitterly recall the Jimmy Carter years, the stagflation and the general economic malaise where the misery index went through the roof. Yet the later 1970s has employment rates that were significantly better than Reagan's early years, so what happened there? Did Carter cut taxes? No. There is a much more powerful force in America, a force that most people do not understand or sorely underestimate. This force is our central bank or better known as the Federal Reserve. Observe the following:

This chart represents non-revolving credit or straight up loans held by the consumer. Loans are driven by banks and certain conditions that promote lending. Before we discuss conditions for lending, compare and contract this chart with the employment chart. Notice that the two charts are almost mirror images of each other and notice that recessions coincide with drops in loans. That is, the more loans held by the public the better the economy and vice versa. Notice also as the loans increase, unemployment drops. Observe that the late 1970s high employment coincided nicely with a credit expansion. Similarly, mid 1980s had an even greater expansion and unemployment dropped even faster.

So what kind of environment is especially conducive to loan generation? First and foremost, short term interest rates. Our interest rates are centrally planned and controlled by the Fed Chairman and the governors of the respective federal reserve banks. Below is the short term rate during the 1980s.

As you can see, the late 1970s and early 1980s experienced some of the highest rates in history. This also coincides with high unemployment and depressed lending activity. It should be no surprise that lending increases as rates drop as it becomes cheaper for banks to lend, but of course there is always a price to pay. The problem with any centrally planned economy is that humans make serious mistakes and when artificially managed rates produce too much lending, booms occur and are always followed by busts. Politicians, public educators and most economists will call this the business cycle. Of course when they screw up it's always the fault of the free market, as if the free market can possibly exist in a land where the rates are centrally planned, banks are insured from failure and money has no actual value. But interest rates are not the only way to flood an economy with money.

There is another way to increase lending and one of the primary methods of inflation in this country; creation of credit. This is done via the commercial banks and are always backstopped by the lender of last resort - the Federal Reserve. Below is the chart that depicts total money supply, known as M2.

What you see above is critically important. This essentially shows the expansion and contraction of the amount of money, the one thing we really hate to see expand. Because as the amount of money increases prices invariably go up! What you see above is an example of inflation and deflation. Note: This is a chart representing yearly change, the higher the peaks the higher the rate of change. Our total money supply continues to grow, as can be seen by significant price jumps in both the 70s and 80s.

You can see that combined with total money supply and low interest rates, the amount of credit available is at it's highest. This high amount of credit then promotes an economic boom, high employment and general happiness. Sadly this boom is not generated due to real and meaningful reasons and will invariably result in a bust. This is a nutshell explains the boom of the 1980s and the subsequent bust, caused a recession, forced Bush Sr. to raise taxes and brought in Bill Clinton. Hopefully you are realizing that presidents and their policies are not the driving force, instead as they say, it's the economy stupid.

As a final indication that America's economy revolves around the expansion of credit, observe the total loans issued by commercial banks.

Although we could infer from previous charts that some kind of expansion fueled the non-revolving credit, the above chart demonstrates clearly what drives our economy. You can see clearly what caused the recession of the early 80s and 90s and the massive expansion of loans during the Reagan boom time.

The Catch

Conclusion

What inspired me to write this, is the constant and incessant push by Republicans and conservatives for a revival of the Reagan economic policy. A local talk show host by the name of Jay Severin today mentioned that Scott Brown's ascension into the US Senate will finally offer salvation in the form of across the board tax cuts. How sad it is when such a respected "libertarian" voice lacks what appears to be basic economic knowledge. You see, Reagan's tax cuts were primarily driven to accomplish one thing and one thing only. Promote consumption. While Reagonomics can be best described as Monetarist stemming from the Chicago school of thought, they are still Keynesian in nature. That is to say, both schools rely on consumer spending to lift the economy out of whatever centrally planned hole it finds itself in. Difference being that Keynesians foolishly rely on government spending, while Monetarists rely on consumer spending via employment investments and tax cuts. Former being Statist, evil and broken and the latter being partially correct provided economic expansion is driven by real investments and not more debt. A credit expansion like the one starting in the early 1980s worked very well given the high concentration of savings that occurred during the 1970s (high interest rates promoted that), so while the dramatic expansion did invariably lead to a boom/bust cycle the foundation was "solid". It is absolutely paramount to understand however that all subsequent booms were launched with cheap credit and loose monetary policy from the Federal Reserve. This is the catch and the hallmark of the past several decades. Our ruling class refused to accept and experience a natural contraction and instead preferred the good times of the boom that were no longer based on solid savings (like late 1970s), but cheap and easy to obtain credit.

The problem is further exacerbated by a government that sees economic expansion and ramps up the spending putting more and more pressure on future generations to clean up the mess. Unfortunately spending that is a function of debt can only go so far and will eventually have to be corrected via debt defaults, contraction and recessions. Sadly when the taxpayer gets demolished during a recession, our government fails to understand that it's previous spending was merely a function of a credit boom and instead of reigning in spending levies more taxes and expands social welfare!

What you see above is not sustainable, not real and HAS to be corrected and you can also get a glimpse of why this time it is quite different. An economy built on a house of credit cards will not stand. Furthermore a political base that failed to understand and comprehend the Reagan era, fails to understand the chart above will never lead us out of our impending economic hardships.

Ironically the economic ignorance behind pushing for a Reagan style across the board tax cut will have the opposite effect! All extra money will be used to pay down outstanding consumer leverage, further contract credit and put the federal government further into debt!

We need to be the party of REAL fiscal sanity and push for fundamental changes that will fix our ailing financial sector. Instead of implementing economic policies that only made sense 30 years ago, we should instead push for more transparency of the federal reserve system, break down the insanity of the FDIC, talk about sound money and how to restore value to our currency. This is the path to economic salvation, we can no longer operate under economic ignorance and hope that another cheap credit boom can buy us a few more years of happiness.

Comments

Post a Comment